Modernizing Payments

Snaptech has been a steady advocate and key player in ushering in the era of Fintech in an industry traditionally known to be exceptionally slow at adopting groundbreaking technology. Our involvement has fueled rapidly acceleration of innovation and secured market-leading positions for our clients.

The financial industry faces a unique set of challenges due to significant governmental regulation and security requirements — necessities for safeguarding monetary instruments from accidental mishandling, corruption, fraud, or theft. Not surprisingly these types of challenges aren't assignable to a majority of software vendors even if they are trustworthy enough to engage in other sensitive areas in the first place.

Over the past decade Snaptech has been a key partner in assisting in securing regulatory and security compliance while simultaneously modernizing payment platforms in a manner that migrated many services previously exclusively available via banks to large corporations into the SMB, mom/pop, and QSR arena.

Their Challenge

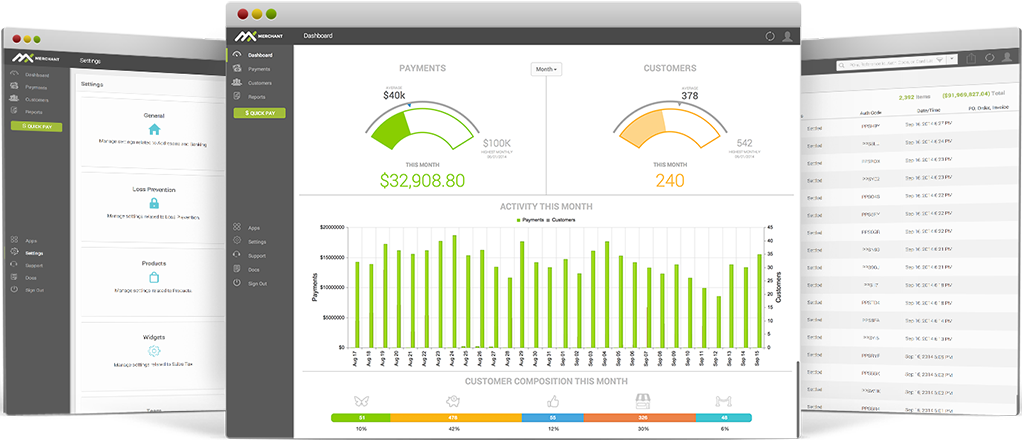

Design a reliable cloud-based, geographically redundant, public facing SaaS platform from the ground up alongside the construction of a versioned and self-documenting public API to equip merchants to process transactions, manage inventory, offer rewards programs, monitor cash flow, detect fraud, maintain PCI compliance, access comprehensive reporting, and invoice and track customers, among numerous other features.

Our Contribution

We were given sole responsibility for all architecture and implementation of the initial platform alongside a single internal developer and delivered and maintained a product that served our clients customers reliably for over eight years. The REST API morphed rapidly from ASCX technology, to WCF, and eventually migrated to WebAPI 1 & 2 with some portions on NodeJS.

A subsequent major initiative, started in 2015, involved modernizing the UI by converting to Angular. Snaptech's enterprise-oriented layout and libraries for lazy-loading, security, modularity, and coding patterns were licensed to rapidly focus on features rather than scaffolding from scratch. The upgrade replaced the old system in its entirety in mid-2016 complete with a sleek UI and new features.

Snaptech continues to lead the team...

Today Snaptech continues to lead the team on this product with feature enhancements as well as the oversight and training of new developers. In 2017 and 2018, we began modernizing to service-oriented API's running under NodeJS and executing in Kubernetes clusters with Docker containers for security, scalability and massively parallelizable software development.

About The

Results

What began as an idea in 2008 and 2 developers expanded to 10 within two years and resulted in a market-dominant product serving merchants across North America including several Snaptech clients.

Merchants reached

3rd party app integrations

of payments processed

All offered under a single SaaS platform

The Tech

- JavaScript –– Custom built libraries

- Angular –– Open-source, mature, well-documented

- Kendo UI –– Open-source, well-documented, powerful & uniform UX, charts

- .NET WebAPI 2 (C#) –– REST-based versioned API

- .NET LINQ/Reflection (C#) –– Custom auto-generated code-based documentation

- NodeJs / Express –– Lightweight, open-source, scalable, modern API

- MSSQL –– Powerful, relational, SP-based

- ORM (Task-based, async, .NET) –– Custom reflection-based solution by Snaptech

- Custom –– Analytics / Reporting by Snaptech

- iOS app

- GitHub –– Code management

- vCloud